In mid-November, everyone receives a new offer from their current health insurance provider. You would be deceiving yourself if you think that means the only thing to change is the price. It is important to check the policy conditions. If you have a restitutiepolis (non-contracted care policy), you are free to choose your healthcare providers. If you have a naturapolis (contracted care policy) or budgetpolis (low-budget policy) and you want to stay with the same insurer, you should check whether your HIV treatment centre, general practitioner and other care providers (e.g. physiotherapist and dentist) will continue to be reimbursed under the same conditions in 2021. If that is not the case, it is better to switch to the slightly more expensive restitutiepolis.

In brief:

- Policy conditions change every year: what was reimbursed in 2020 will not necessarily be reimbursed in 2021.

- 31 December 2020: the final date for cancellation of your health insurance.

- 31 January 2021: the final date for taking out a new health insurance policy, as long as you have terminated the old one no later than 31 December 2020 (your health insurance policy will then start retroactively on 1 January 2021).

- Use a comparison website to check whether you are not paying too much for your health insurance.

- A restitutiepolis give you a free choice with healthcare. Choice is limited with a naturapolis or a budgetpolis and sometimes you have to pay extra.

- The Hiv Vereniging (Dutch HIV Association) offers its members a group discount on a number of health insurance policies.

- If you have a low income, you might be able to take out a gemeentepolis (a group health insurance plan offered by your local municipality).

- Membership of the Hiv Vereniging is sometimes fully, or partially, reimbursed by aanvullende zorgverzekering (supplementary health insurance).

Which insurance is best?

It is not possible to recommend one particular insurance for people with HIV. Everyone is different and everyone needs different kinds of care. One person may want a lot of physiotherapy, another a lot of dental care, a third may want both. Also, constant telephone access to a customer service might be extremely important to you. On the other hand, you may prefer to do your business online. So it's important to figure out which health insurance policy is best for you.

Important dates

The health insurers must announce the premiums for their new policies by 12 November 2021. If you switch to a new insurer before or on 31 December 2021, you automatically cancel the policy with your old insurer. Your new insurance then starts on 1 January 2022. If you need more time to think about it, you can cancel your old health insurance by 31 December 2021, and apply for a new insurance by 31 January 2022. Your new insurance then will take effect retroactively, starting on 1 January 2022.

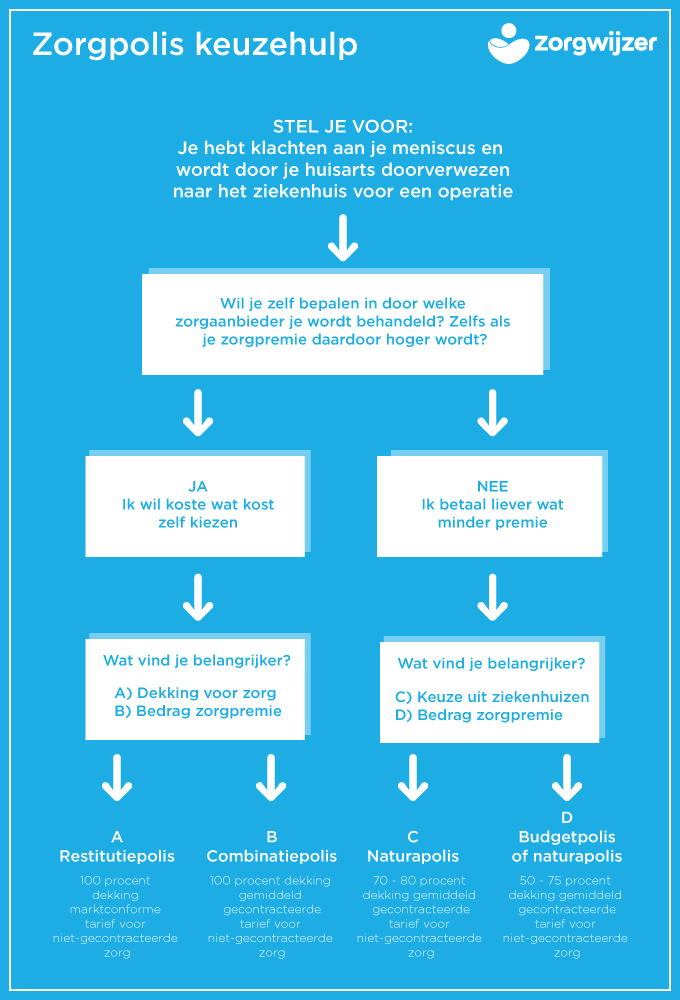

What type of policy? Take a critical look!

If you want to avoid unpleasant surprises wherever possible, then take a restitutiepolis, under no circumstances a budgetpolis, and preferably not a naturapolis either. The differences between types of policy (restitutiepolissen, naturapolissen and budgetpolissen) are becoming increasingly large. We know from past experience, that more and more insured people are faced with unpleasant surprises, like additional payments for medicines or treatments. So take a critical look at your policy and the policy conditions.

restitutiepolis

The Hiv Vereniging advises everyone with HIV to take out a restitutiepolis. This policy may be more expensive, but it means you avoid having to pay extra for part of a doctor’s or hospital bill. It also means you avoid travel expenses to a hospital or clinic that the insurer has a contract with. With a restitutiepolis, you are always free to choose your doctors and other healthcare providers, at no extra cost.

Supplementary insurance

People are increasingly doing without supplementary insurance. This is a way of reducing their monthly expenses. But if you expect higher healthcare costs when it comes to physiotherapy (especially if you play sports and are at risk of sports injuries), or alternative medicine, or dental costs, you have to weigh up the risks against the costs. The longer we live with HIV, the more likely we are to have HIV-related symptoms of old age. These can include mobility, muscle and joint problems. Physiotherapy is then important.

Supplementary insurance covers healthcare costs that are not covered by basic insurance. This mainly concerns dental care, physiotherapy, alternative medicine and orthodontics. If you expect high or higher healthcare costs, supplementary insurance can sometimes be advantageous. Please note: if you don’t yet have supplementary insurance, some insurers will ask questions about your health. Sometimes they don't want chronically ill people, but sometimes they don't have a problem with HIV. They are allowed to refuse you supplementary insurance, so there is little you can do about it.

want everything covered?

If you have a low income and/or not much savings, it could be safer to opt for supplementary insurance. The monthly costs can increase substantially, maybe to more than €100. But then you have just about every risk covered. A rheumatic patient can be insured for unlimited visits to a physiotherapist, or for compensation for the eigen bijdrage (personal contribution) for certain medicines. But laser eye treatment or the procurement of medical aids could also be a reason to take out supplementary insurance. Find out more on ‘good calculations’.

This general acceptance rule no longer applies to supplementary insurances. So you should check first whether another insurer will accept you. If you enter your preferences for supplementary insurance on a vergelijkingssite (comparison site) like the Consumentenbond (Dutch Consumer Association - in Dutch), you find out instantly whether they will accept you.

Don't cancel your supplementary insurance until you are sure your new health insurer has accepted you. By the way, you are not obliged to take out your basic insurance and your supplementary health insurance with the same health insurer. However, if you take out supplementary insurance with a different insurer, you may be charged extra. This can amount to more than 50% of the premium for the supplementary insurance.

Changes in 'eigen risico' (the excess that has to be paid for health costs) and 'premie' (premium)

The eigen risico and the price of the basic insurance can change every year. The maximum eigen bijdrage (personal contribution) can also vary each year.

Want to save money? Think about this!

It makes sense to fill in your details on a healthcare comparison site, because a lot changes every year. This shows you which basic insurance and which supplementary insurance is the cheapest. It is often cheaper to switch health insurers than to stay with the same health insurer for years on end.

comparison

You can compare the costs of basic and supplementary insurances by using the Consumentenbond Zorgvergelijker (Consumers’ Association Comparison Tool - in Dutch). Please note: the Consumentenbond has a broad selection, but also a slight commercial interest: sometimes you can join a group insurance plan through the Consumentenbond. Click here (in Dutch) for a list of all health insurances (including supplementary), the costs and what is reimbursed.

Misconceptions

There are many misconceptions about health insurance. For example, about the healthcare providers available within a policy. Or that new pharmacy that has a different contract. Watch out for pitfalls.

medication

Every year, each insurer determines which medication it will reimburse and the level of that reimbursement. So the policy may look different every year, even though your situation has not changed. So it's possible your medication was fully reimbursed in 2020, but in 2021 you have to pay an additional charge. The restitutiepolis offers the best approach.

Health insurers and reimbursement of membership

The website zorgwijzer.nl (in Dutch) offers an overview of health insurers that reimburse membership fees fully, partially, or not at all. This overview lists what each health insurer has to offer. Health insurers often attach a condition to reimbursement. This is whether a patient organisation is affiliated to the Patiëntenfederatie (NPCF) and Ieder(in). The Hiv Vereniging is affiliated to both the Patiëntenfederatie and Ieder(in). Do they ask for proof of affiliation? The Patiëntenfederatie (NPCF - in Dutch) website states that the Hiv Vereniging is affiliated. Ieder(in) proof of affiliation - pdf download here (90 KB).

Inform yourself, search in the overview for your health insurance or contact your insurance company if you have questions. If your health insurer reimburses the membership from supplementary insurance, or partially does, please contact your insurer to get a refund of the membership costs.

Healthcare allowance

Healthcare allowance is a reimbursement from the Dutch government for people with a Dutch health insurance. To be eligible, you must meet certain conditions. For example, the allowance depends on the composition of your household and on the level of your income. You can calculate your entitlement yourself using a test calculation (in Dutch) on the website of the Belastingdienst (tax office).

Problems with delivery of HIV medication?

In recent years, relatively more people with HIV have had problems with delivery of their HIV medication to the pharmacy. According to the law, you are allowed to pick up a three-month supply of medication. Sometimes people still only receive a one-month supply of HIV medication. Since 2017, the Hiv Vereniging has been mapping out which insurers still have medication delivery problems.

Since 1 January 2020, all health insurers state in their terms and conditions: medication (including HIV medication) costing more than €1,000 a month may be given for a three-month period, as long as the person with HIV is properly adjusted (i.e. using a medication that suits them and suppresses the virus – usually after six months). Read more here (in Dutch). If you do experience problems with the delivery of medication, or do not receive a three-month supply of medication, we ask you to inform the Servicepunt of the Hiv Vereniging.

Health insurance when travelling

The basic insurance sometimes covers less than you think. For example, the costs of emergency medical care abroad are indeed reimbursed. But only at the Dutch rate. The costs are much higher in many holiday destinations. Don't be surprised by a massive hospital bill. For example, you can take out supplementary insurance that covers all the costs of emergency care. But these costs will often be covered as well by travel insurance with medical cover.